Editor's Note: Jimmy Zhu is chief strategist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

Growth pickup in China industrial production and retail sales in November largely beat the earlier estimates, which are likely to help the nation's GDP growth in the fourth quarter gain the first acceleration since the first quarter of last year.

Three reasons that drove the growth in industrial production

Industrial production grew 6.2 percent in November from a year ago, much higher than a 4.7 percent growth in October. The growth is also much better than economists' earlier estimates at 4.7 percent. Sub-indices show that auto manufacturing, machinery and ferrous metals smelting industries all outperformed, growing 7.7 percent, 12.6 percent and 10.7 percent respectively.

The pickup in factory output further confirms that the industrial activities may have started picking up last month, a sign that was reflected in November's manufacturing PMI as well. China's manufacturing PMI surged to 50.2 last month, from 49.3 in the previous month.

Among all the economic data in China, industrial production holds the highest correlation with the nation's GDP growth. Correlation between the two stands at 0.963 in the past 10 years. The average growth rate of industrial production rose 5.5 percent in the first two months of the fourth quarter, versus the 5 percent average monthly growth in the third quarter. The regression analysis model shows that GDP growth for this quarter may stand at 6.1 percent, faster than the 6.0 percent growth rate in the third quarter.

There are mainly three reasons behind the pickup in factory output last month.

1) External demand is improving after global central banks vowed to lower the borrowing cost to boost the business confidence. JP Morgan global manufacturing PMI rose to 50.3 last month, first time above the 50-threshold since April. China factory output may have reached the bottom in August in the same month when the global PMI started to rise.

2) Outperforming in ferrous metals smelting sector shows that infrastructure investment continues to pick up. China has increased its purchases on iron ore in the third quarter, a sign that factory demands are recovering as iron ore is largely used in industrial activities such as steel mining.

3) Visible pickup in China aggregate financing. Authorities have been encouraging the lenders to offer more support to the local business. Aggregate financing reached 1.75 trillion yuan in November, and this amount is nearly triple to October's reading. Meanwhile, there are substantial improvements in the nation's medium and small sized companies' PMI last month, another sign that the recovery in the activities is more broad-based.

Singles' day sales and Shanghai stocks boosted retail sales

China retail sales grew eight percent in November from a year ago – the fastest pace since June. By looking at the sub-indices, those categories showing substantial increase could be largely driven by the Singles' day sales in November period. The cosmetics sector grew 16.8 percent from the previous 6.2 percent; household electronics grew 9.7 percent – much higher than the 0.7 percent reading in October, office supplies also recorded a positive growth at 4.6 percent last month from a 3.4 percent contraction in the previous month.

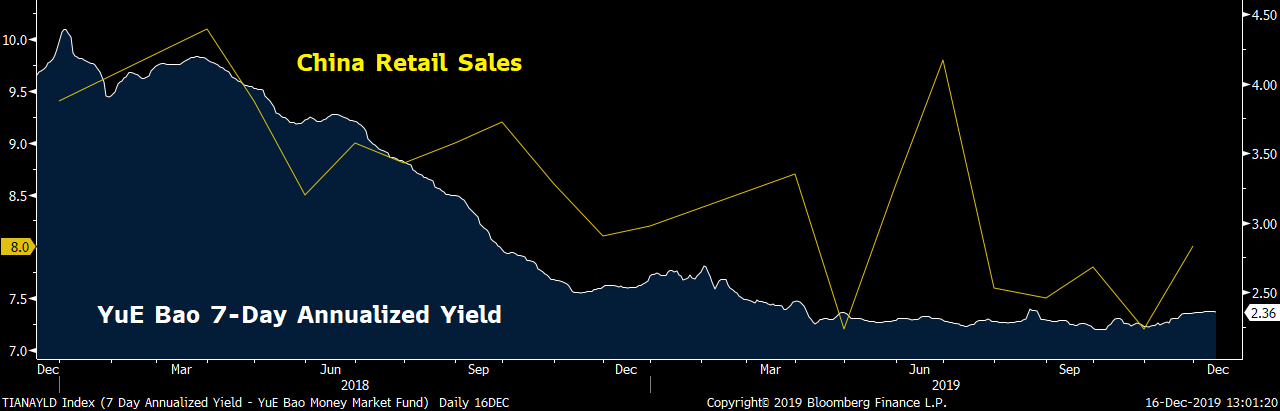

Stabilization in Shanghai stocks is another major factor that drove the increases in retail sales last month. A chart below shows growth in retail sales have been consistently moving in tandem with Shanghai stocks in the past two years. Since the early fourth quarter, hopes on China and U.S. to reach a partial deal by the end of the year have increased, inducing investors to increase their portfolio holding in the local stocks market.

Increases in stocks value in many other countries were driven by the central banks' monetary easing, which harm the savers' interest as their saving rates moved lower as well. However, this is not the scenario in China. Data shows that Yu'e Bao 7-day annualized yield, one of the benchmark products to reflect the trend of interest rates offered by those wealth management products, started to increase in early November. Higher returns in wealth management products also help to increase consumers spending power.

What may happen after U.S.-China "phase one" deal

Looking ahead, U.S. and China reached the "phase one" deal last Friday. However, the first official de-escalation in a 20-month trade tension will help boost Chinese business confidence, increase their risk appetite for further investment, and see a hiring expansion.

Besides that, increasing the purchasing in U.S. agriculture products would indirectly increase the policy room of the People's Bank of China (PBOC) in 2020. One of the main constraints for the Chinese central bank to further ease the monetary condition is high pork prices. Hence, increase the supplies through the purchase of overseas pork may help to reduce prices, offering more policy room for the PBOC to counter the challenges in the manufacturing sectors.