Industrial and Commercial Bank of China (ICBC) is the last Chinese bank to have suspended access for new investors to crude oil products due to extreme oil futures volatility.

Investors already holding ICBC's crude oil products will not be able to add to their positions from Tuesday, and same goes for other commodity-linked retail products, but existing positions can be traded normally, the bank said on its website (link in Chinese) on Monday.

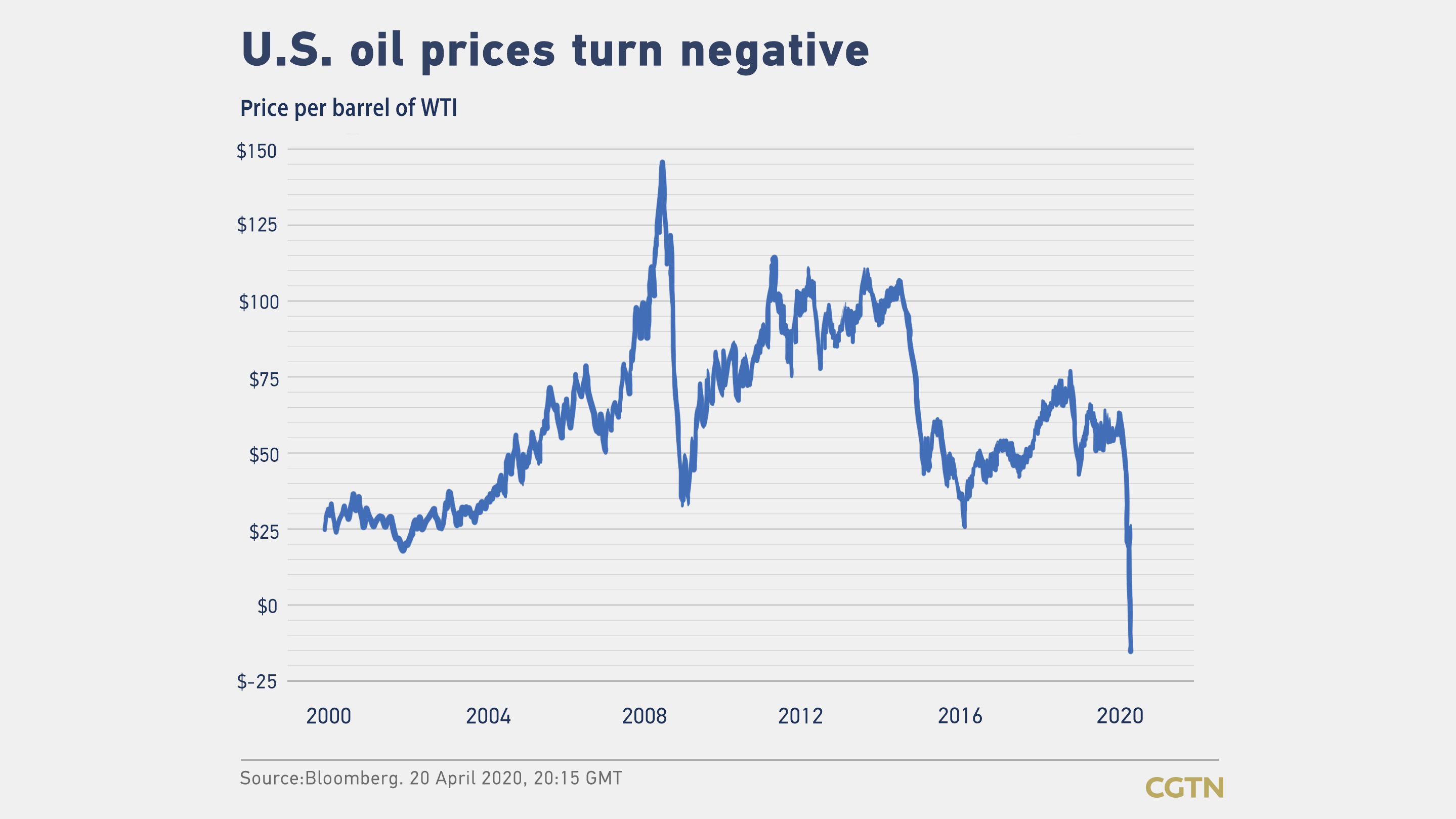

Oil prices have plunged this year due to economic damage caused by the coronavirus, a price war triggered by Saudi Arabia and Russia, and insufficient storage space for excess oil, causing steep falls in many linked products.

ICBC also warned retail investors they could lose all their investments and cash deposits in the commodity-linked products.

"The debate in China is about whether those products were suitable for the retail market," a commodity source in China said. "Commodities are a very risky investment, as oil proved last week."

Prices of other commodities included in ICBC's retail investor products, such as natural gas, soybeans and copper, have also been volatile. ICBC's website says these products are linked to global futures contracts.

The crude oil product is linked to WTI traded on the foreign exchange company CME and Brent traded on financial market company ICE, while the natural gas products are linked to the New York Mercantile Exchange's futures contract.

ICBC's copper products are linked to the futures contract on COMEX and soybean products to the contract traded on the Chicago Board of Trade.

ICBC's moves follows Bank of China (BOC) which last week said it would settle its crude oil futures product at a historic negative value of -37.63 U.S. dollars per barrel.

Retail investors may have lost more than nine billion yuan (1.27 billion U.S. dollars) from BOC's crude oil product, according to report.

Chinese investors who traded BOC crude oil products say it should have done more to protect their interests. BOC said last week in a statement (link in Chinese) that it was "deeply disturbed" by investor losses and would work to protect their interests.

China Construction Bank and China's Bank of Communications also closed their crude oil trading products to new investment last week, and China Minsheng Bank closed it from Monday.

Shanghai Pudong Development Bank, which also already barred new investment for its crude oil products last week, said on Monday that its copper and soybean products for retail investors would also be closed to new investment from Tuesday.

All six Chinese banks that offer crude oil trading products have suspended transactions to open new positions.

Oil-focused exchange-traded products, including the biggest U.S. oil ETP the United States Oil Fund LP, also face potential steep losses due to the WTI price drop.

(With input from Reuters)

(Cover: The logo of Industrial and Commercial Bank of China is pictured at the entrance to its branch in Beijing, China, April 1, 2019. /Reuters)