World shares rose on Thursday after China's exports came in far stronger than expected, suggesting an economic recovery was under way, but the dollar fell from two-week highs as U.S. data showed millions more Americans joined the ranks of the unemployed.

Gold jumped 2 percent as the weak U.S. data heightened fears over a coronavirus-induced global downturn.

Initial U.S. jobless claims for unemployment benefits totaled a seasonally adjusted 3.169 million for the end of last week, down from a revised 3.846 million in the week prior, the U.S. Labor Department's weekly report showed.

The data reinforced economists' expectations of a protracted recovery for the U.S. economy, which is reeling from lockdowns across the country to slow the spread of the coronavirus pandemic.

"The pace is slowing down, which is providing some optimism that we are finally going to see things bottom out," Ed Moya, senior market analyst at OANDA, said of the unemployment claims.

Investors took heart on news that Moderna Inc said it could start trials for a COVID-19 vaccine by early summer.

"The more vaccine trials that are out there, the more optimism that one will stick," Moya said.

Technology stocks again led Wall Street higher as investors bet on a recovery, pushing the Nasdaq into the black for the year after equity markets had plunged from all-time highs in February.

Stocks globally were bolstered after Beijing reported a 3.5 percent rise in exports in April from a year earlier, confounding expectations of a 15.7 percent fall and outweighing a 14.2 percent drop in imports.

The strong showing boosted speculation China could recover from its coronavirus lockdown faster than expected and support global growth in the process.

The Dow Jones Industrial Average rose 211.25 points, or 0.89 percent, to 23,875.89, the S&P 500 gained 32.77 points, or 1.15 percent, to 2,881.19, and the Nasdaq Composite added 125.27 points, or 1.41 percent, to 8,979.66,.

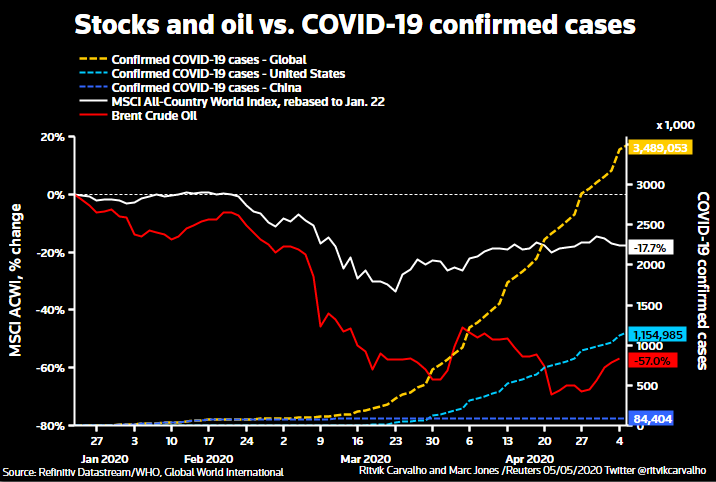

MSCI's gauge of stocks across the globe gained 0.93 percent.

"It's clear that this virus has gone from east to west and we are now seeing that in the data," said Societe Generale's Kit Juckes, pointing to the China numbers and relatively better purchasing managing data in countries such as Australia.

But with the full economic impact of the pandemic still to be seen and huge amounts of debt potentially pushing up borrowing costs, "the market is hugely split between die-hard bears and buy-on-dip buyers," he added.

U.S. President Donald Trump said he would be able to report in about a week or two whether China is meeting its obligations under a trade deal, as Washington weighed punitive action against Beijing over its handling of the coronavirus outbreak.

And much of the economic data remained grim, with the Bank of England warning that the coronavirus crisis could cause the country's biggest economic slump in 300 years.

"Despite their dizzying rally, we continue to be cautious on equities in the near term," Luca Paolini, chief strategist at asset manager Pictet, said. "Markets seem to be overestimating the speed of economic recovery."

(Cover image: A pedestrian wearing a face mask rides an escalator near an overpass with an electronic board showing stock information, following an outbreak of the coronavirus disease COVID-19, at Lujiazui financial district in Shanghai, China, March 17, 2020. /Reuters)

(With input from Reuters)