Imported vehicles waiting to be delivered to the 4S shops in the parking lot of Shanghai Haitong International Automobile Terminal Co., Ltd. April 26, 2020. /VCG

Imported vehicles waiting to be delivered to the 4S shops in the parking lot of Shanghai Haitong International Automobile Terminal Co., Ltd. April 26, 2020. /VCG

China's monthly auto sales rose for the first time in 22 months as factories restarted production following easing virus-related curbs, said the country's largest auto industry association.

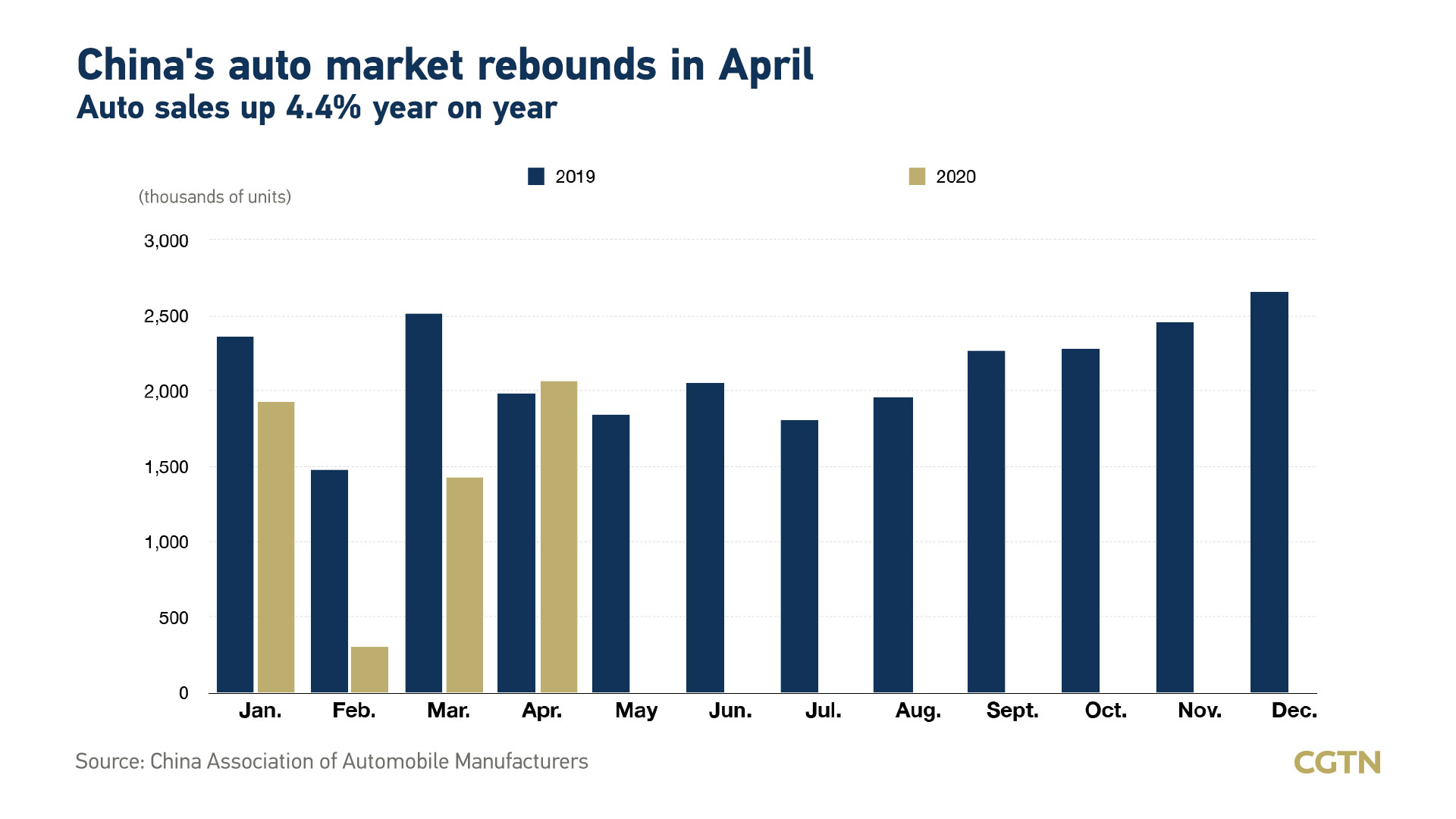

The sales data for April shows "encouraging sings" of China's auto business. The auto sales reached 2.07 million units last month, growing 4.4 percent compared to last year, according to a monthly report by the China Association of Automobile Manufacturers (CAAM). Harmed by the COVID-19 pandemic, the country's auto sales sank 79 percent in February. After that, the sales showed a "warm up" in March but was still 43 percent lower than last year.

While the overseas spread of the virus may have affected consumer confidence, pent-up demand combined with consumption-spurring policies have offset the negative impacts, the China Passenger Car Association noted, adding slumping oil prices in the international market also played a part.

China last saw a monthly sales rise in June 2018.

Commercial vehicle sales surge

Sales of commercial cars in China surged to a record high last month, amounting to 534,000 units with a 31.6-percent jump year on year. Among them, heavy trucks saw the largest sales growth of 191,000 units, up 61.0 percent from last year.

"The demand (for heavy trucks) was previously suppressed because of the pandemic, but now it has begun to be released," said Thomas Zhang, head of Greater China Analysis at Uzabase, a Japanese business intelligence firm, in an interview with CGTN.

The pent-up demand may have also been provoked by the launch of the "New Infrastructure" campaign, an innovation-driven program to offset the economic impact of the coronavirus pandemic and boost sustainable growth, said Liu Baohua, editor-in-chief of monthly magazine Auto Business Review.

"Another reason is China's highways were planned to be free until June 30," Liu told CGTN, pointing out that announcement in February has stimulated a lot of logistics enterprises to buy trucks since the "highway fee is not a small amount."

A Mercedes Actros truck at the booth of German truck maker Mercedes Benz at the IAA truck show in Hanover, September 22, 2016. /Reuters

A Mercedes Actros truck at the booth of German truck maker Mercedes Benz at the IAA truck show in Hanover, September 22, 2016. /Reuters

Passenger car sales are on a recovery track, too. The retail sales of passenger vehicles amounted to 1.54 million units in April, slightly down from last year but narrowed by 45.8 percentage points from March, according to CAAM.

Even though China has extended new energy vehicles (NEVs) subsidies to encourage the purchases, sales of them fell for a 10th month to 72,000 units, down 16.5 percent year on year, CAAM data shows.

NEVs are battery-powered electric, plug-in hybrid and hydrogen fuel-cell vehicles.

At the end of March, China had decided to extend subsidies and tax exemptions for NEVs purchases by another two years, which were set to expire at the end of this year.

The move to extend subsidies gives NEVs a cost-price advantage of more than 20 percent over traditional fuel vehicles, a hugely favorable policy worth tens of billions yuan.

However, the positive effect has not shown up yet in the data.

"Extending the subsidies will not promote the sales of NEVs this year," said Liu, "because people who should have bought NEVs this year may extend their decisions to the next two years."

Also, Liu believes the decreasing subsidies are not attractive to consumers anymore. "The subsidies already decreased last year," said the chief editor, adding that the effect of COVID-19 has added to the decrease.

China cut subsidies by 10 percent this year, and will in principle cut them by 20 percent in 2021 and 30 percent in 2022 respectively.

Zhang considered the reason of the decrease of NEVs sales to be that most NEVs are passenger cars, which didn't boom up as much as commercial cars did in April. In addition, he said the subsidy extension has not had enough time to be seen in the sales data.

Tesla China-made Model 3 vehicles are seen during a delivery event in the factory in Shanghai, China January 7, 2020. /Reuters

Tesla China-made Model 3 vehicles are seen during a delivery event in the factory in Shanghai, China January 7, 2020. /Reuters

Virus to still slam global demand

However, challenges are still going to be faced by the world's biggest auto market as the coronavirus is slashing the global demand.

Chinese automobile exports came in at 70,000 units in April, down 15.7 percent year on year and 22.9 percent from March.

"Auto sales growth should remain weak due to the short-lived nature of pent-up demand, impaired income of households and still-elevated uncertainty," said Japanese financial holding company Nomura in a weekly newsletter reviewed by CGTN.

Even if the virus is contained effectively in China and overseas, auto sales in China are expected to drop by 15 percent this year, from over 25 million units in 2019, CAAM said, and the figure is expected to drop by 25 percent if the pandemic still spreads around the globe.

(Graphic by Qu Bo)