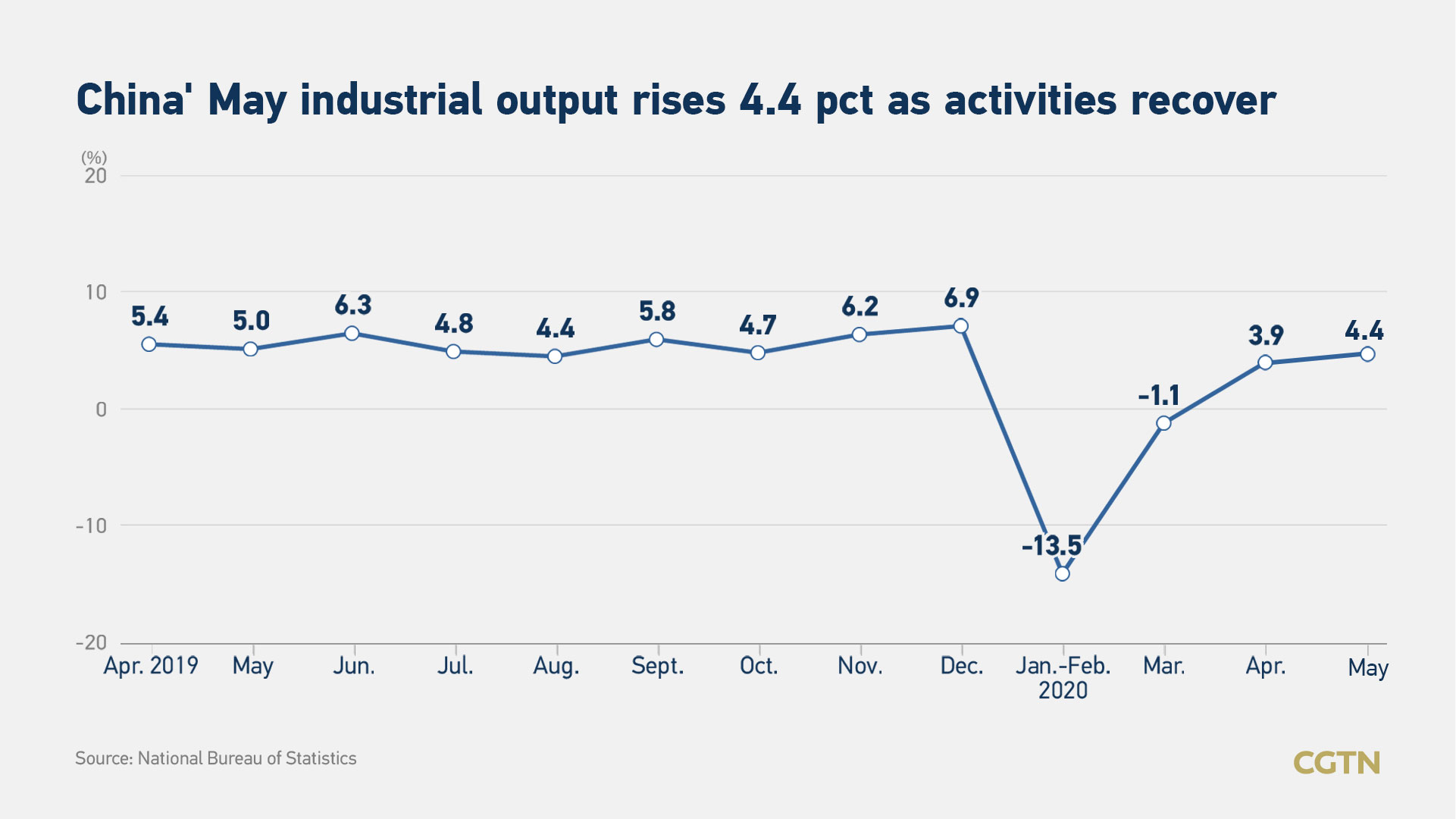

China's value-added industrial output expanded 4.4 percent year on year in May, but retail and investment stayed negative as slow economic recovery continues amid COVID-19 control, official data showed on Monday.

Industrial output, a gauge of manufacturing, mining and utilities sector activity, was up from 3.9 percent growth in April, but slightly below the forecast of five percent by the Bloomberg and Reuters polls of analysts. Within it, manufacturing grew by 5.2 percent, mining was up 1.1 percent and utilities by 3.6 percent, according to the National Bureau of Statistics (NBS).

"Although the main indicators continued to improve in May, many were lower than the same period last year, indicating that economic losses caused by the epidemic still needs to be compensated, and that the economy has not returned to normal," NBS spokesman Fu Linghui said.

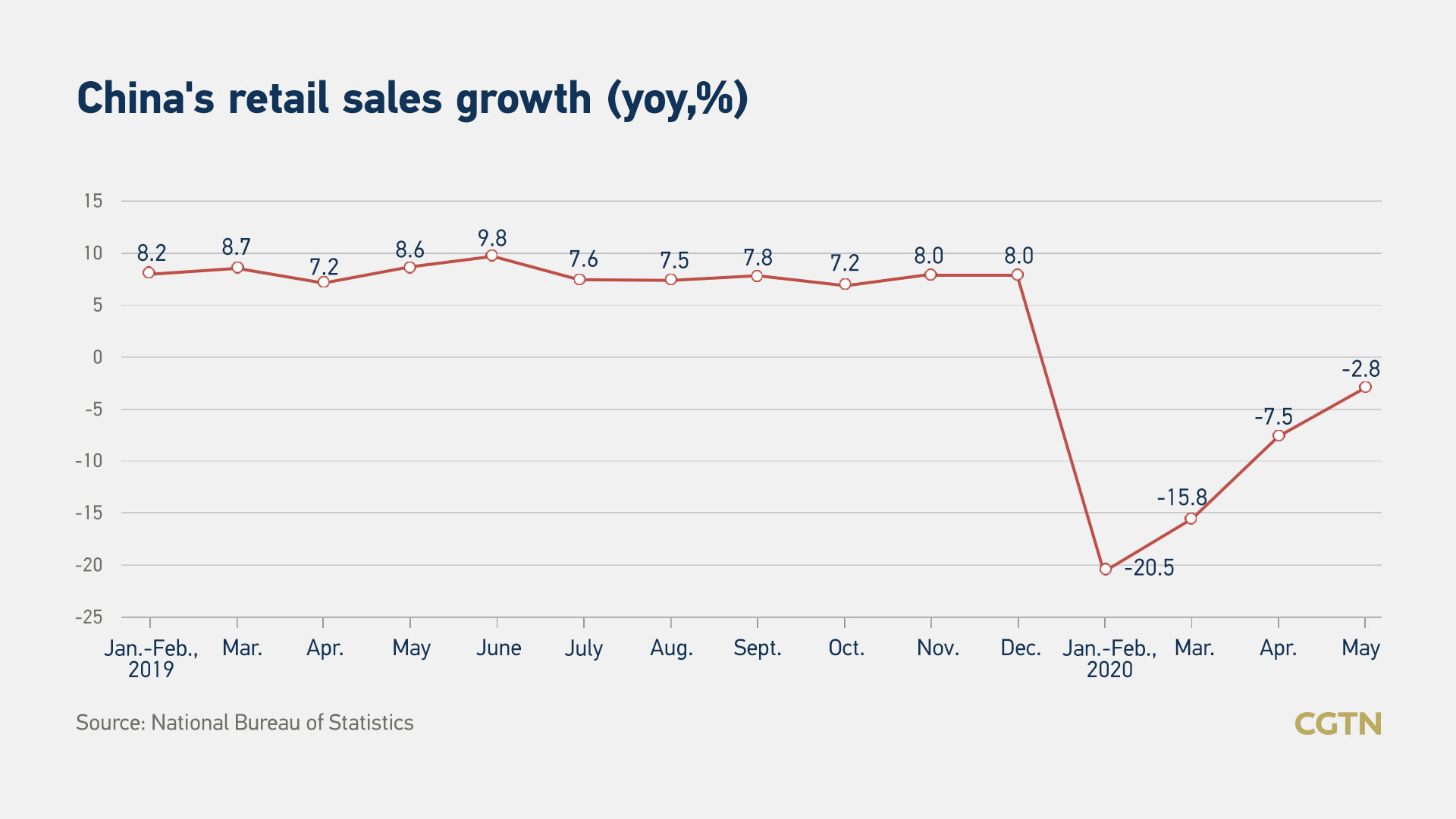

Retail sales, a crucial indicator of consumption in the world's biggest consumer market, fell 2.8 percent year on year, more than a predicted decline of two percent by Reuters.

"Retail sales growth remained negative due to the remaining social distancing rules. The COVID-19 outbreak in Beijing over the past weekend was a shock to the Chinese government and we believe the risk of a second wave in China has risen significantly just over the past weekend," economists from Nomura Securities said in an email to CGTN.

The Chinese mainland reported 49 confirmed new COVID-19 cases on Sunday, of which 36 were reported in Beijing with some form of contact with Xinfadi wholesale market in the capital city's southern Fengtai District. The market that sells fruits, vegetables and meat was closed after the new cluster of coronavirus cases emerged.

"Retail sales will probably get worse in June because of new coronavirus infections in Beijing, and it will affect industrial output and investment, and even employment. CPI in June is likely to rise above three percent. The economic recovery will be slower in the third quarter," Chen Fengying, a research fellow at the China Institutes of Contemporary International Relations told CGTN.

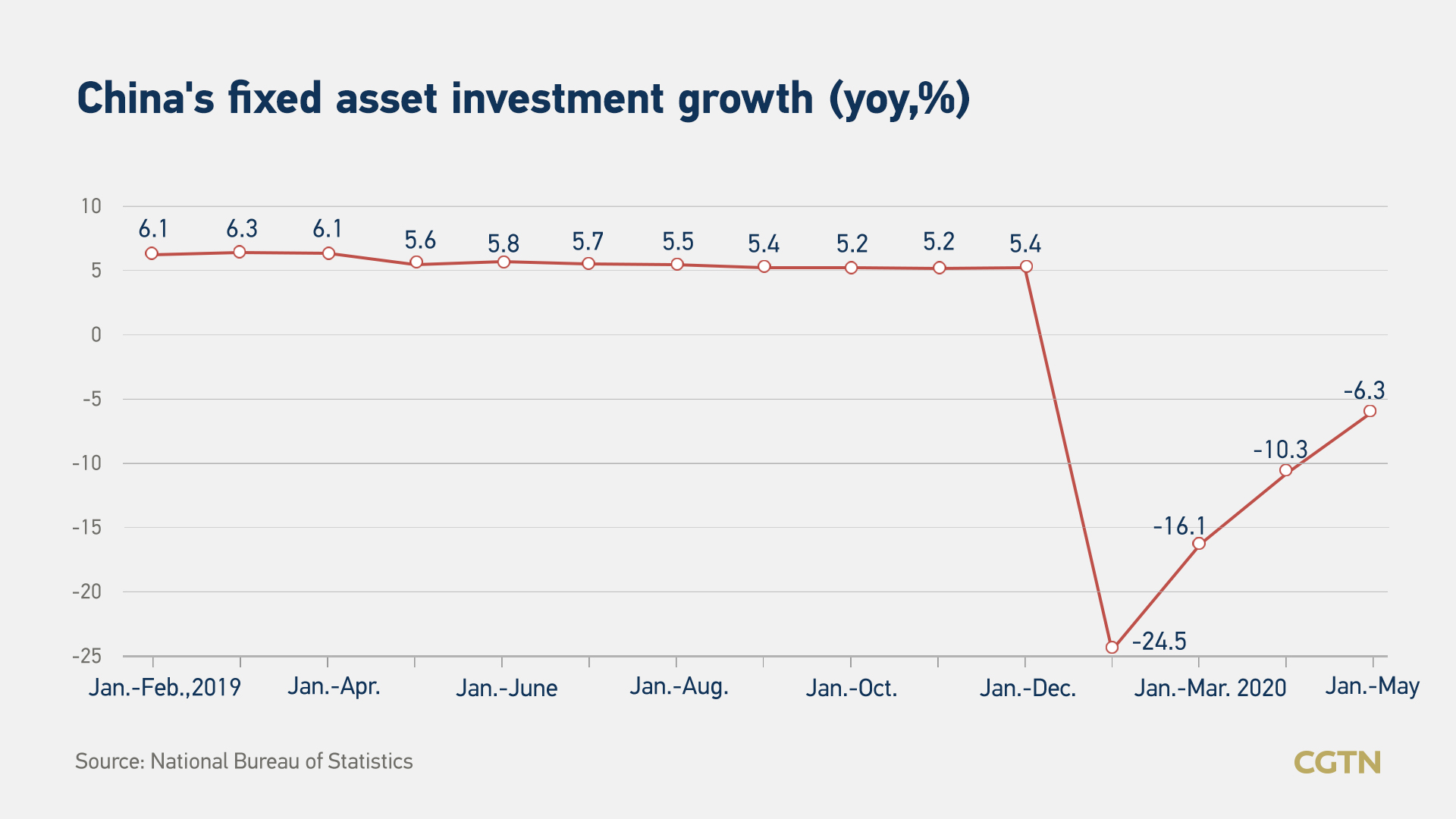

Fixed asset investment, the year-to-date value of spending on real estate, infrastructure and capital equipment, dropped 6.3 percent between January and May from the same period last year, worse than a forecast fall of 5.9 percent by Reuters.

Investment in infrastructure, manufacturing and real estate edged down separately 6.3 percent, 14.8 percent and 0.3 percent year on year in the first five months of the year, narrowing from the decline of 11.8 percent, 18.8 percent and 3.3 percent between January and April.

However, both retail sales and fixed asset investment pointed to some signs of recovery, as they were better than April's reading of minus 7.5 percent and minus 10.3 percent respectively.

"The pent-up demand may not be sustainable, while the strength of catch-up production amid the easing of lockdown measures should also prove unsustainable," economists from Nomura said.

The job market remained generally stable in May, with the surveyed unemployment rate in urban areas standing at 5.9 percent, down 0.1 percentage points from the previous month.

"It should be noted that the overseas epidemic and the global economy have become more complicated. The stable operation of the domestic economy still faces many risks and challenges," Fu added.

The NBS canceled its press conference on Monday, instead releasing the economic data online due to epidemic control efforts.

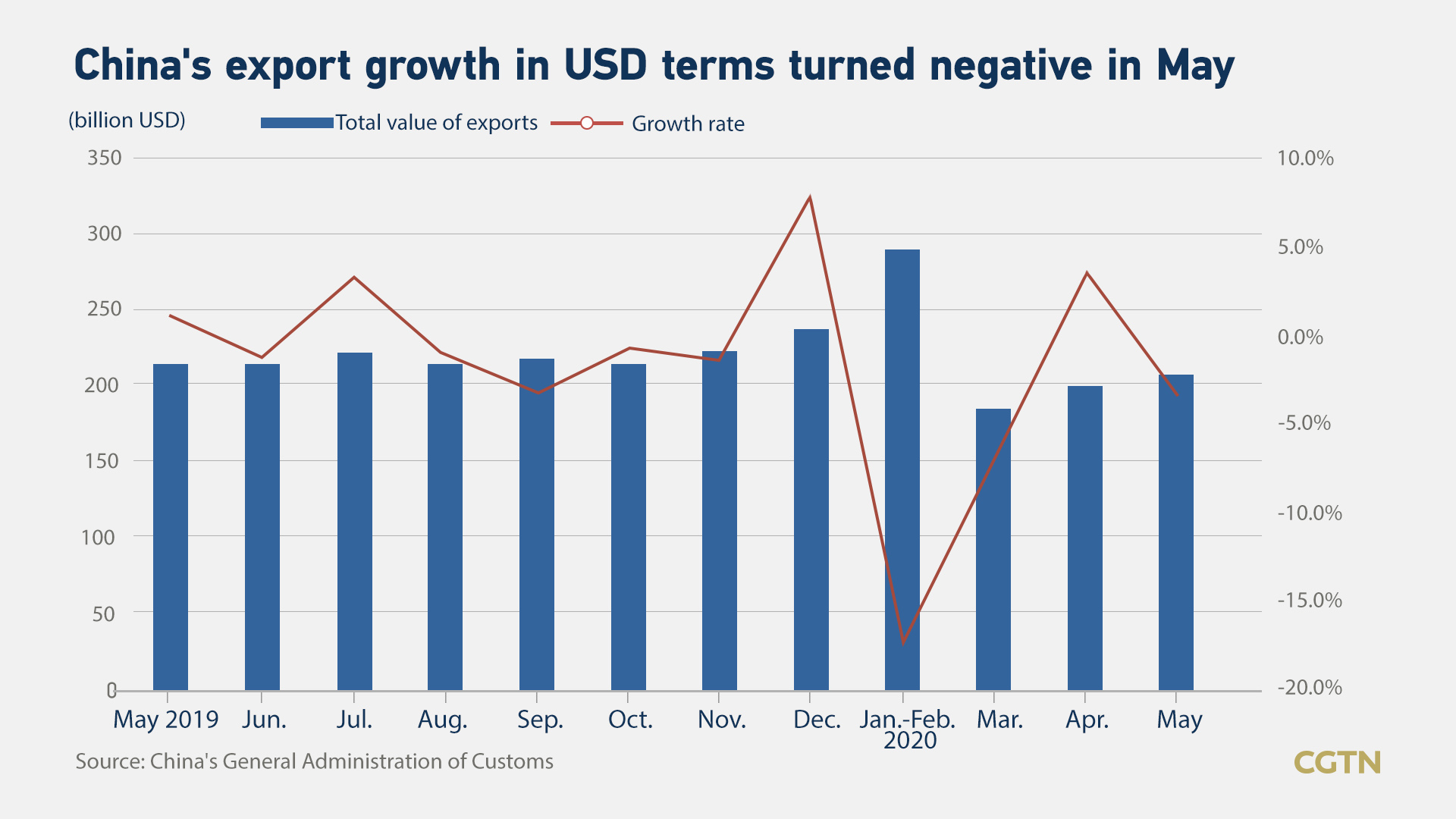

Export growth turns negative

The country's May exports contracted 3.3 percent year on year in U.S. dollar terms as the flare-up of infections is still devastating demand, while a deeper fall of 16.7 percent in imports pointed to mounting pressure facing the manufacturing sector.

"As the COVID-19 situation is showing no signs of fading, China's export growth could worsen further despite the surge in medical product exports," economists from Nomura said.

"The sharp decline of commodity prices was to blame, dragging down import value of crude oil to by 55 percent, while its import volume jumped notably by 27 percentage points to 19 percent. Import volume of iron ore and copper ore both dipped in May, possibly indicating soft related domestic demand," UBS said.

In contrast, import growth of agricultural goods picked up by six percentage points to settle at 12 percent, with a marked gain in soybean and grain, both up by 40 percentage points to reach 25 percent and 29 percent, respectively.

China's foreign trade is facing increasing uncertainties and daunting challenges in 2020, the commerce ministry said in a report released on Monday, adding that its foreign trade will continue to be under pressure in the short to medium term.

The risk of global economic recession is rising, the supply and industrial chains are blocked, and international trade and investment are shrinking. Domestic companies, especially small and medium-sized companies are facing difficulties, with mounting pressure on employment, the ministry added.

CPI growth continuously falls back

China's inflation further sailed into the slowdown territory in May, with its main gauge of the consumer price index (CPI) registering a year-on-year rise of 2.4 percent, 0.8 percent narrower than in April, weighed by a drop in food prices. The reading was lower than the 2.7 percent increase estimated by a Reuters poll and Nomura Securities.

The producer price index (PPI), which measures costs for goods at the factory gate, shed 3.7 percent from a year earlier in May, as compared to a median forecast for a 3.3 percent contraction tipped by a Reuters poll of analysts and a 3.1 percent fall in April.

Allowing for the mild bounce gained in pork prices and floods raging in south China, Nomura Securities reckoned CPI inflation will cease to fall and settle near 2.4 percent year on year in June. But the slide in year-on-year CPI inflation might flare up again in the second half of the year, potentially to just 0.4 percent at year-end.

"We believe falling CPI inflation and continued PPI deflation will provide Beijing with more space to implement policy stimulus to offset the impact of COVID-19 on the economy," Nomura Securities denoted in its latest research report.

Read more:

China's CPI growth continuously falls back in May

Mild price increase in housing market

China's new home prices in 70 major cities showed mild increase compared to one month earlier, with new home prices in four first-tier cities including Beijing, Shanghai, Shenzhen and Guangzhou rising by 0.7 percent month on month in May, up 0.5 percentage points from the previous month, NBS data showed.

"The property market's robust recovery since April leaves limited scope for policy relaxation in the near term. We observed only seven positive policies changes in May, down from 37 in February," Nomura Securities said in its research report.

Read more:

China's housing market recovers further in May

Uptrend in credit growth continues

May's money and credit data were a mixed bag, but the uptrend in credit growth continued, according to Nomura Securities. New yuan loans dropped from 1.7 trillion yuan in April to 1.48 trillion yuan in May, weaker than expected 1.5 trillion yuan by Reuters and 1.8 trillion yuan by Nomura Securities. Meanwhile, new aggregate financing ticked up to 3.19 trillion yuan in May from 3.09 trillion yuan in April, lower than Nomura's prediction of 3.4 trillion yuan.

"The COVID-19 outbreak in Beijing also suggests it is too early for the government to reverse its easing stance. We expect the PBOC to soon cut reserve requirement ratio (RRR) to inject liquidity and accommodate the massive amount of government bond issuance in the pipeline. With inflation falling, we also think the PBOC could cut interest rates, including the one-year benchmark deposit rates and MLF rates," economists from Nomura said.

Nomura Securities recently raised year-on-year real GDP growth forecast in the second quarter to 1.2 percent from minus 0.5 percent and cut GDP growth forecasts in the third quarter and fourth quarter to 4.5 percent and five percent respectively from 5.8 percent. Consequently, they cut 2020 annual GDP growth forecast to 1.3 percent from 1.5 percent. Nomura maintains its 2021 GDP growth forecast at 8.8 percent.