Geely's headquarters in Hangzhou, east China's Zhejiang Province. /VCG

Geely's headquarters in Hangzhou, east China's Zhejiang Province. /VCG

China's automaker Geely on Friday denied market rumors that the group will acquire shares of the country's debt-laden automaker Lifan and participate in bidding for South Korea's struggling SUV maker SsangYong Motor, as it sets out to be the first carmaker listed on China's Nasdaq-style high-tech STAR market.

Yang Xueliang, vice president of the group, replied to recent rumors with "there is no such thing."

It was reported that Hangzhou-based Geely plans to inject fresh capitals into Chongqing-based Lifan to become its top shareholder, according to people familiar with the matter. The price and size of the stake and the amount of fresh capital were not known.

South Korean media also cited unnamed sources, saying on Friday that Geely, one of China's largest private automakers, might be interested in SsangYong, which is 74.65 percent owned by India's Mahindra and Mahindra that could give up its majority stake in SsangYong.

Volvo owner Geely is also the biggest shareholder in Daimler AG, a German multinational automotive corporation.

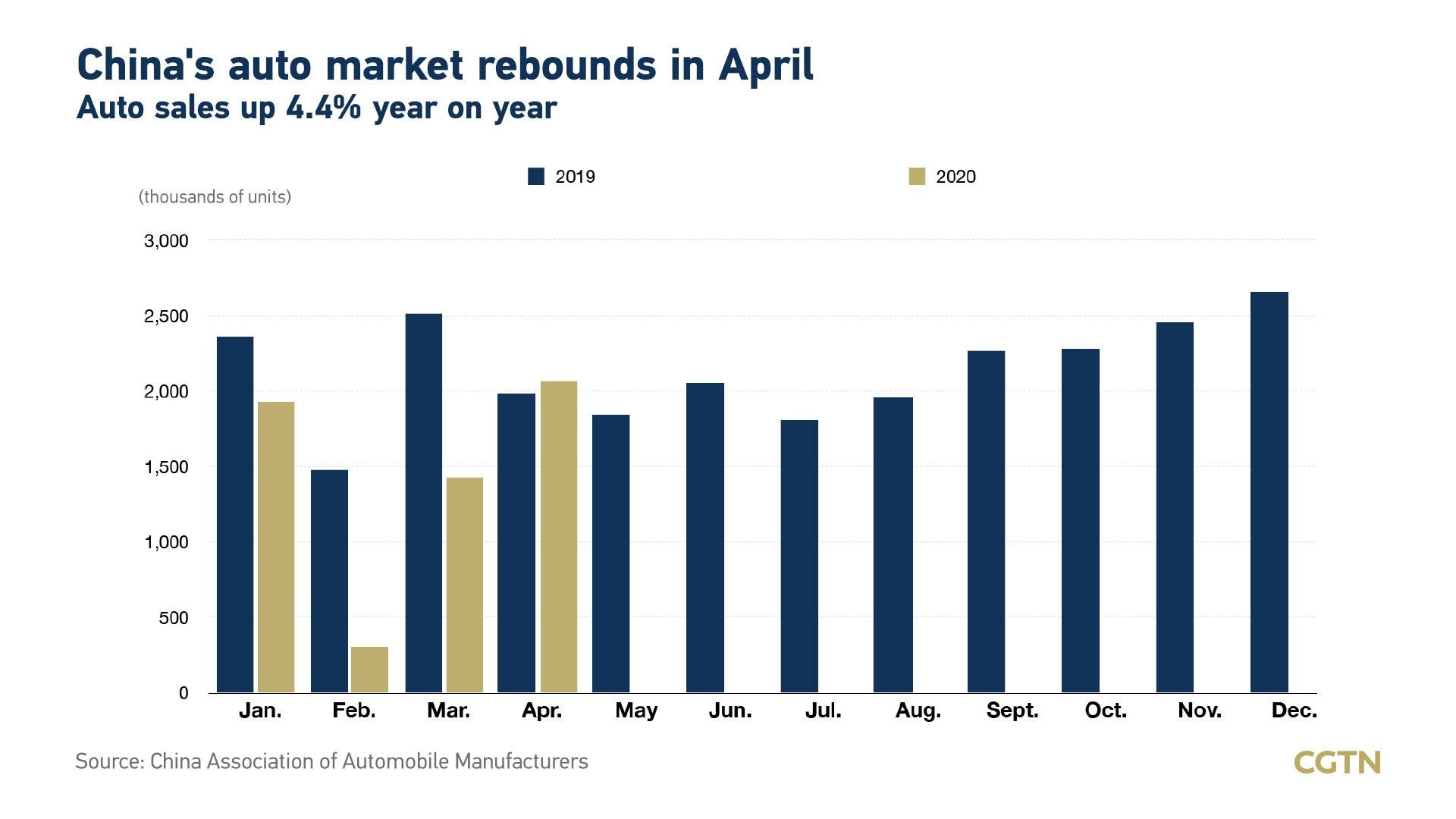

The reported takeover came as China's auto sales ended almost two years of decline in April, growing by 4.4 percent compared to last year, with easing virus-related curbs releasing pent-up demand.

China's biggest automakers expected a changing landscape after the epidemic, with competition in the industries at home and abroad pushing smaller peers into restructuring or bankruptcy.

Lifan's share price lifted the daily trading limit on Friday, jumping to 5.5 yuan per share on the report, with a turnover of nearly 400 million yuan (about 56.5 million U.S. dollars). The stock also rose by 6.84 percent on Thursday.

Founded in 1992, the automaker has seven overseas automobile manufacturing bases and nearly 500 marketing networks all over the world.

However, the debt-laden automaker was battered by a prolonged sales decline due to the COVID-19 outbreak. Debt of the one-time motorcycle maker totaled 31 billion yuan (about 4.4 billion U.S. dollars) last June, with 60 percent due within this year, company filings showed.

Liquidity-starved Lifan will propose a debt restructuring to creditors on Saturday, including asset sales and debt-to-equity swaps, and plans to complete the restructuring as early as August, according to people with knowledge of the matter.

Lifan SUV is showed at Auto Pudong in Shanghai, China, September 29, 2018. /VCG

Lifan SUV is showed at Auto Pudong in Shanghai, China, September 29, 2018. /VCG

Shares in SsangYong finished up 30 percent after the news, valuing at 332 billion won (about 274.6 million U.S. dollars).

Established in 1954, the carmaker has been burdened with high debt and reported its operating loss for 13 consecutive quarters. Its sluggish sales appeared even before the COVID-19 outbreak due to tough competition in the SUV market.

It sold 31,110 vehicles in South Korea between January and May with a decrease of 35 percent year on year. It exported 8,097 vehicles, dropping by 21 percent compared to the same period last year.

SsangYong vehicles in Russia, August 15, 2011. /VCG

SsangYong vehicles in Russia, August 15, 2011. /VCG

Geely issued a statement on Wednesday, saying the initial proposal to list on Shanghai's STAR Market has been approved. If successful, the group will become the first overseas-listed Chinese automaker returning to the A-share STAR Market.

In April, China's top securities regulator has lowered the listing threshold for innovative red-chip companies, or companies registered overseas but operate in the Chinese mainland, to help attract them back to domestic stock markets under a pilot scheme.

Share price of Hong Kong-listed Geely went up 5.9 percent to 12.6 Hong Kong dollars (about 1.6 U.S. dollars) per share on Thursday after the announcement. As of Tuesday, its market value was at 116.7 billion Hong Kong dollars (about 15.1 billion U.S. dollars).

The automaker in May sold 108,822 vehicles in China, with 20-percent year-on-year growth, outperforming industry averages. It has topped auto sales among independent brands in China for three consecutive years.