The G20, which was formed in 1999 at the ministerial level, was widely applauded for its critical role in the world's response to the global financial crisis.

In November 2008, at the height of a crisis that started in the U.S., a stimulus package was put together at the first G20 Leaders' Summit that many argue saved the global economy from slipping into a depression.

Could the G20 play a key role in coordinating a global response to the pandemic too?

Eyes are on the 2020 G20 Leaders' Summit, which will be held virtually from November 21 to 22 under the theme "Realising Opportunities of the 21st Century for All."

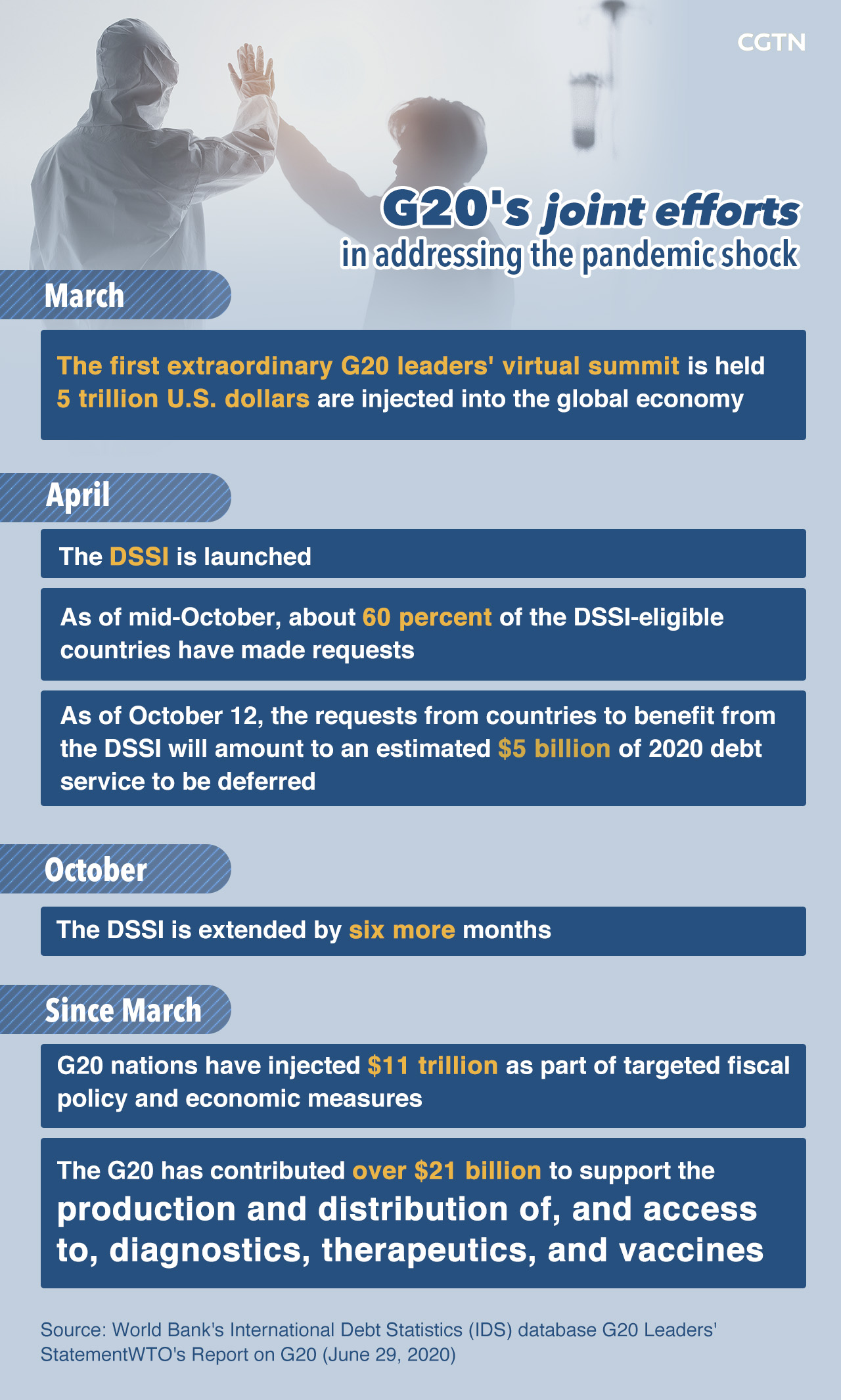

DSSI – collective efforts by G20 nations

Before the onset of the COVID-19 crisis, an International Monetary Fund (IMF) paper published in February found that 36 of 70 low-income countries (LICs) were at high risk of debt distress or already in debt distress.

The COVID-19 pandemic has since pushed debt levels to new heights and triggered the deepest global recession since World War II.

According to recent reports, the official bilateral debt of the poorest countries to G20 countries hit $178 billion in 2019 and over 100 low- and middle-income countries will still have to pay a total of $130 billion in debt service in 2020.

Given the urgency of the debt crisis, the G20 has taken probably the most important collective action in response to the pandemic – the Debt Service Suspension Initiative (DSSI), which means that bilateral official creditors will, during a limited period, halt debt service payments from the poorest countries (73 low- and lower middle-income countries) if they ask for a suspension.

The World Bank's Development Committee and G20 Finance Ministers endorsed the DSSI in April, granting debt-service suspension to the poorest countries to help them manage the severe economic impact of the pandemic.

Since then, virtual conferences and ministerial meetings have been held at regular intervals.

During the second virtual meeting, G20 countries agreed to suspend debt service payments for the world's poorest countries through the end of the year.

During the third meeting, the ministers welcomed the progress achieved under the DSSI. It has benefited 43 countries to-date and the relief has been extended by six months.

Meanwhile, G20 countries have agreed to examine the need for a further extension by the time of the IMF-World Bank Spring Meetings in April 2021.

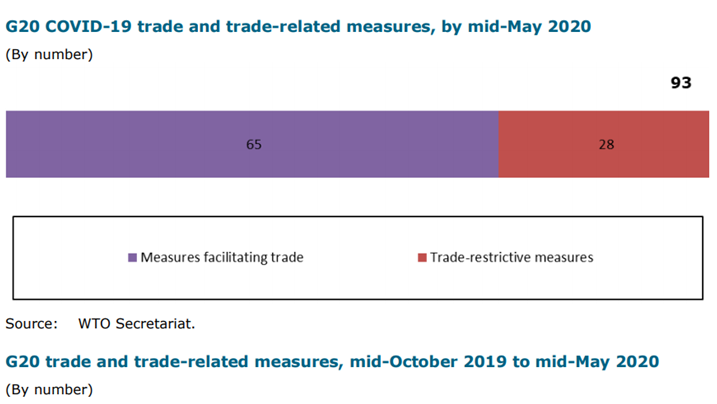

Screenshot from WTO website

Screenshot from WTO website

They have also launched a debt suspension initiative for the least developed countries that would allow beneficiary countries to defer $14 billion in debt payments due this year and use the money instead for financing their health systems and social programs.

"In the early stages of the pandemic, several of the measures introduced by G20 economies restricted the free flow of trade, principally for exports. But as of mid-May 2020, 70 (percent) of all COVID-19 related measures were trade-facilitating," according to the World Trade Organization's latest G20 trade report.

China's predominant role in the DSSI

According to the World Bank, as of 2018, 72 developing countries owed Chinese creditors $104 billion out of total debt of $514 billion. That amount includes loans direct from China's government, from "policy banks," such as the China Development Bank, and profit-seeking loans from state-owned commercial lenders.

The amount lent by Chinese creditors accounts for about 20 percent of the total foreign debt owed by the 73 governments eligible for the G20 initiative, and about 30 percent of their debt service this year.

Meanwhile, China is the only G20 country expected to see positive economic output this year, according to the Organization for Economic Cooperation and Development, which forecast Chinese growth this year of 1.8 percent, from a 3.7 percent contraction projected in June.

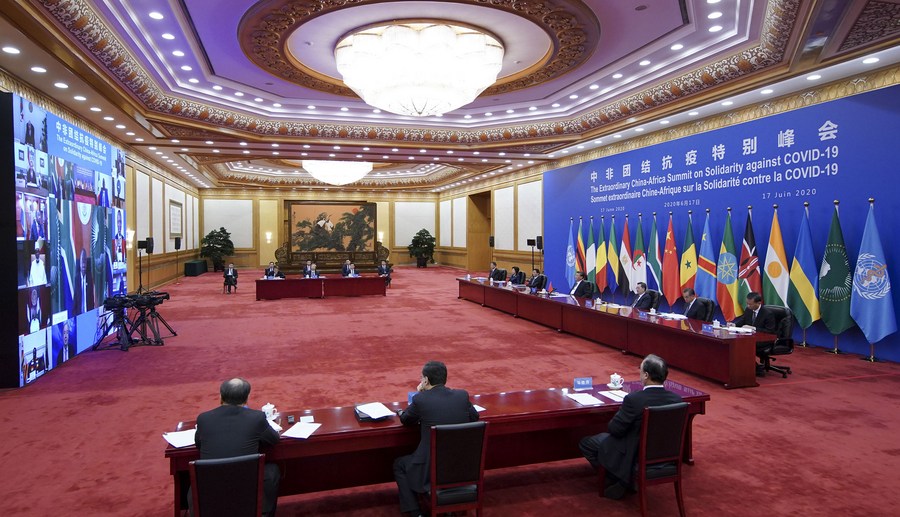

Chinese President Xi Jinping chairs the Extraordinary China-Africa Summit on Solidarity against COVID-19 and delivers a keynote speech at the summit in Beijing, June 17, 2020. /Xinhua

Chinese President Xi Jinping chairs the Extraordinary China-Africa Summit on Solidarity against COVID-19 and delivers a keynote speech at the summit in Beijing, June 17, 2020. /Xinhua

Thus, many have wondered how China, the biggest lender, would play its part in the global debt-relief initiative, especially the attitude and methods the country would take in dealing with debt issues in Africa.

Chinese President Xi Jinping was the first to propose an extension of the DSSI into 2021 at the Extraordinary China–Africa Summit on Solidarity Against COVID-19 on June 17.

Read more:

China's waiving of African nations' debt a sign of global economic responsibility

At present, the Export-Import Bank of China, as an official bilateral creditor, has signed debt suspension agreements with 11 African countries. Other non-official creditors have also reached consensus on debt relief with some African countries with reference to the DSSI, according to China's foreign ministry.

The China Development Bank, as a commercial creditor, also signed agreements with developing countries involving $748 million by the end of September, according to the Finance Ministry.

China will also waive interest-free loans due to mature by the end of 2020 for 15 African countries, and continue to push the international community, especially the G20, to further extend the duration of debt suspension, said spokesperson Zhao Lijian at a regular press conference in October.

The total debt service payments suspended by China amount to $1.353 billion under the G20's DSSI, ranking first among G20 members in terms of deferral amount, according to Finance Minister Liu Kun.

China's debt service suspension benefits 23 countries, said Liu in an interview on Friday, adding that "this is an important deliverable that China contributes for the upcoming G20 Leaders' Summit."

Urgency in further progress

While progress has been made in addressing debt relief, many challenges remain.

"Some core DSSI-related problems are still unresolved, notably lack of participation by private creditors and incomplete participation by some official bilateral creditors," World Bank Group President David Malpass said.

DSSI-eligible countries have $31 billion of payments due in the period covered. Bilateral official creditors, multilateral official creditors and private creditors are owed 35, 23 and 42 percent, respectively, in debt service payments.

Currently, only three out of 44 countries have signed up for the program reaching out to private creditors.

Read more:

Coordinated management of the sovereign debt problem uneasy

Malpass also noted that the DSSI, which defers payments into the future but doesn't reduce them, has been a "stopgap" to provide fiscal resources for the poorer countries while a longer-term solution for the debt crisis can be developed.

"It's urgent to make rapid progress on a framework because the risk of disorderly defaults is rising," he said.

Experts noted that considering the severity of the pandemic-induced recession, the DSSI is only the start of sovereign debt restructuring cooperation.

Read more:

Graphics: How does G20 use tech in joint fight against COVID-19?

How has G20 contributed to global fight against COVID-19?

Expectations are high that G20 leaders will put aside their differences and realize the promise made in the statement from Saudi Arabia's G20 presidency – the G20, the world's premier platform for international economic cooperation, is at the forefront of the fight against the global COVID-19 pandemic.